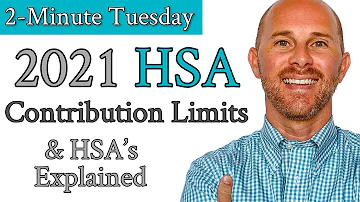

Do you have to pro Rate Your HSA contributions?

Do you have to pro Rate Your HSA contributions?

You must pro-rate your contribution based on the number of months during which you were HSA-eligible on the first day of the month.

Are there limits on how much you can contribute to a HSA plan?

The maximum HSA contribution limit can change from year to year and varies depending on whether you have self-only (individual) coverage or a family insurance plan. The table below shows contribution limits for both 2020 and 2021. Table source: Internal Revenue Service (IRS).

How much can I contribute to my health savings account in 2020?

Salary reduction contributions to your health FSA for 2020 are limited to $2,750 a year. This inflation adjusted amount is listed in Revenue Procedure 2019-44, section 3.17, available at IRS.gov/pub/irs-drop/rp-19-44.

Are there limits on out of pocket for HSAs?

The HHS's annual out-of-pocket limits are higher than those set by the IRS, but to qualify as an HSA-compatible HDHP, a plan must not exceed the IRS's lower out-of-pocket maximums. On May 14, HHS published the Notice of Benefit and Payment Parameters final rule for 2021 and posted a fact sheet that summarizes its most significant changes.